Having an emergency fund is a crucial aspect of wealth building, as it serves as a safety net for unforeseen financial circumstances. By setting aside a dedicated fund for emergencies, you protect your investments and long-term financial goals from the impact of unexpected expenses. It not only provides peace of mind but also ensures that you stay on track with your wealth-building journey, avoiding setbacks that could derail your progress. Let’s dive deeper into why establishing and maintaining an emergency fund is a key component of your financial success.

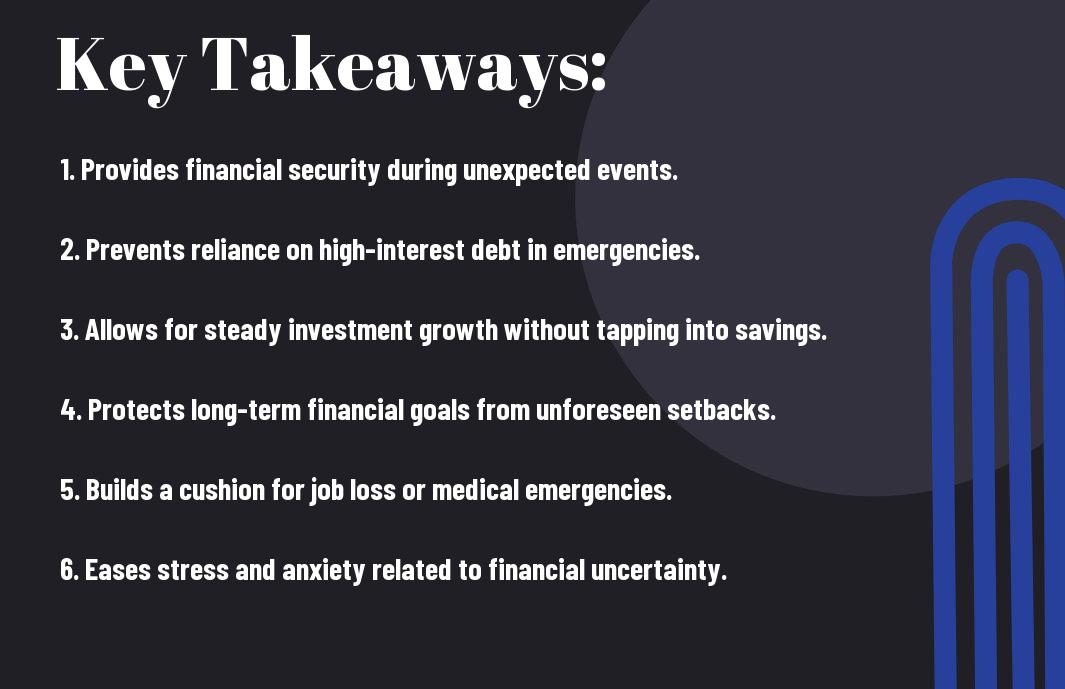

Key Takeaways:

- Financial Security: Having an emergency fund provides a safety net in times of unexpected expenses or financial emergencies, preventing individuals from going into debt.

- Stability and Opportunity: A well-funded emergency fund allows individuals to remain financially stable during tough times and take advantage of investment opportunities without having to liquidate other assets.

- Peace of Mind: Knowing that there is a cushion to fall back on in emergencies can reduce stress and anxiety, enabling individuals to focus on long-term wealth building and financial goals.

Why Emergency Funds Matter

While building wealth, one of the crucial components to consider is having an emergency fund. This fund serves as a safety net for unforeseen expenses or financial emergencies that may arise. It is necessary to have readily accessible cash to cover unexpected costs without derailing your long-term financial goals. To learn more about what an emergency fund is and why it is important, you can check out this article What is an emergency fund, and why is it important?.

Avoiding Debt Traps

To avoid falling into debt traps, having an emergency fund is crucial. When unexpected expenses arise, such as medical bills, car repairs, or home maintenance issues, having a financial cushion can help you cover these costs without resorting to borrowing money at high interest rates. By having an emergency fund in place, you can protect yourself from accumulating unnecessary debt and prevent it from becoming a burden on your financial health.

Reducing Financial Stress

To reduce financial stress, having an emergency fund can provide peace of mind knowing that you have the financial resources to handle unexpected situations. Financial emergencies can be stressful and can disrupt your long-term financial plans. With an emergency fund in place, you can weather these storms with confidence, knowing that you have the means to address them without jeopardizing your financial stability.

Debt can take a toll on your mental and emotional well-being. By having an emergency fund to rely on in times of need, you can avoid the added stress of accumulating debt to deal with unexpected expenses. This financial safety net can give you a sense of security and help you stay on track towards your wealth-building goals.

Building Wealth with Emergency Funds

It is important to have an emergency fund as part of your wealth-building strategy. This fund serves as a safety net to protect you from unexpected financial setbacks and allows you to stay on track with your long-term financial goals.

Creating a Safety Net

Emergency funds provide peace of mind, knowing that you have a buffer to cover any unforeseen expenses such as medical emergencies, car repairs, or job loss. By having this financial cushion, you can avoid going into debt or dipping into your investments when unexpected costs arise.

Freeing Up Resources for Investments

Funds set aside for emergencies free up resources for you to focus on building your wealth through investments. Instead of using your investment funds to cover unexpected expenses, you can rely on your emergency fund, allowing your investments to grow uninterrupted.

To maximize the growth of your wealth, it is crucial to prioritize building an emergency fund before focusing on other investment opportunities. By having a financial safety net in place, you can weather any financial storms that come your way and continue on the path to building long-term wealth.

Common Obstacles to Building an Emergency Fund

Despite the importance of having an emergency fund, there are common obstacles that may hinder your progress in building one. One such obstacle is living paycheck to paycheck, which can make it challenging to set aside funds for unexpected expenses.

Living Paycheck to Paycheck

Common among many individuals is the struggle of living paycheck to paycheck, where every cent is allocated to cover important bills and expenses. In such a scenario, it becomes difficult to save any extra money for emergencies, leaving you vulnerable to financial setbacks.

Prioritizing Wants over Needs

Any financial expert will tell you that distinguishing between wants and needs is crucial for building wealth. However, prioritizing wants over needs can derail your efforts to establish an emergency fund. Splurging on non-important items instead of setting aside money for unforeseen circumstances can leave you financially unprepared when emergencies arise.

When you prioritize wants over needs, you may find yourself constantly struggling to make ends meet and lacking the financial security that comes with having an emergency fund. It’s important to evaluate your spending habits and prioritize saving for emergencies to ensure long-term financial stability.

Wants

Identifying your wants and needs is a critical step in wealth building. By differentiating between the two, you can make conscious decisions that align with your financial goals and help you secure a better future. Recall, prioritizing needs over wants can pave the way for a more secure financial future.

Calculating Your Emergency Fund Needs

Assessing Your Expenses

For many people, knowing where to start when calculating your emergency fund needs can be overwhelming. The first step is to assess your monthly expenses. Go through your bills, receipts, and other financial records to determine how much you typically spend each month on vitals such as rent or mortgage, utilities, groceries, transportation, insurance, and other necessary expenses.

Determining Your Emergency Fund Size

The next step in calculating your emergency fund needs is determining how many months of expenses you want to cover. Financial experts often recommend having three to six months’ worth of living expenses saved up in your emergency fund. This is to ensure that you have an adequate cash reserve to cover unexpected financial setbacks, such as a job loss or a major medical expense.

The size of your emergency fund may vary depending on your individual circumstances. If you have a stable job and a good insurance policy, you may feel comfortable with a smaller emergency fund. On the other hand, if you are self-employed or have dependents, you may want to aim for a larger emergency fund to provide a greater financial cushion.

Strategies for Building an Emergency Fund

Many individuals often find it challenging to start building an emergency fund. If you’re unsure where to begin, check out this Emergency fund: What it is and why you should have one article from Fidelity for a comprehensive guide. One effective way to kickstart your emergency fund is by starting small.

Starting Small

With your initial goal, you can start by setting aside a small amount each month, even if it’s just $20 or $50. The key is to consistently contribute to your fund, no matter how small the amount. Over time, these contributions will add up, and you’ll gradually build a financial cushion to rely on in times of need.

Automating Your Savings

The best way to ensure you’re consistently saving for your emergency fund is to automate the process. The idea is to set up automatic transfers from your checking account to your savings account. This way, you won’t even have to think about saving – it happens automatically without you having to remember.

For instance, you can schedule a monthly transfer of a set amount to your emergency fund right after your paycheck is deposited. By automating your savings, you remove the temptation to spend that money elsewhere and make building your emergency fund a priority.

Cutting Expenses and Increasing Income

Strategies like cutting unnecessary expenses and finding ways to increase your income can also help you grow your emergency fund faster. Evaluate your monthly expenses and see where you can make cuts – whether it’s eating out less often, reducing subscription services, or finding more affordable alternatives. Additionally, consider taking on a part-time job or freelancing gigs to bring in extra income that can be directly allocated to your emergency fund.

By actively seeking ways to reduce your expenses and boost your income, you’ll be able to accelerate the growth of your emergency fund. Keep in mind, every little bit helps, and the more you can save, the better prepared you’ll be for unexpected financial challenges.

Managing Your Emergency Fund

Your emergency fund is a crucial component of your financial health. To make sure it serves its purpose when needed, you must manage it effectively. Here are some key strategies to help you manage your emergency fund:

Keeping Your Fund Liquid

Fund liquidity refers to how quickly you can access your money when an emergency arises. It’s important to keep your emergency fund in a liquid account, such as a high-yield savings account, money market account, or short-term CDs. These accounts allow you to withdraw funds easily without facing penalties or restrictions.

Avoiding the Temptation to Spend

Keeping your emergency fund separate from your regular checking or savings accounts can help you resist the temptation to dip into it for non-emergencies. It’s crucial to establish a mindset that your emergency fund is off-limits for anything other than true emergencies like medical expenses, car repairs, or unexpected home repairs.

A good practice is to create a budget that includes saving for specific goals, such as vacations or electronics, separate from your emergency fund. This separation can help you mentally distinguish between funds meant for emergencies and those for discretionary spending.

Regularly Reviewing and Adjusting

Managing your emergency fund is an ongoing process. It’s important to regularly review your financial situation and adjust your fund size as needed. Life changes, such as getting married, having children, or buying a house, can impact the amount you need in your emergency fund. Make it a habit to review your fund at least once a year or whenever a significant life event occurs.

Your emergency fund should reflect your current financial responsibilities and potential risks. By regularly reassessing and adjusting your fund, you can ensure that you have an adequate safety net to protect you in times of financial uncertainty.

Summing up

As a reminder, having an emergency fund is a crucial aspect of wealth building. It provides you with a financial buffer during unexpected circumstances, allowing you to avoid going into debt and derailing your financial health. By having an emergency fund, you can maintain your progress towards your financial goals and protect yourself from the unforeseen challenges that life may throw your way. To learn more about the importance of emergency funds, you can read this article on Emergency Fund: What it Is and Why it Matters.

FAQ

Q: Why is having an emergency fund important in wealth building?

A: Having an emergency fund is crucial in wealth building because it provides a financial cushion to cover unexpected expenses such as medical emergencies, car repairs, or job loss without derailing your long-term financial goals.

Q: How does an emergency fund contribute to financial stability?

A: An emergency fund helps maintain financial stability by preventing individuals from going into debt to cover unforeseen expenses. This fund acts as a safety net, ensuring that you can continue to meet your financial obligations without dipping into your savings or investments.

Q: What is the recommended amount to have in an emergency fund?

A: Financial experts typically advise having 3 to 6 months’ worth of living expenses saved in an emergency fund. However, the actual amount may vary based on individual circumstances such as income stability, monthly expenses, and risk tolerance.