As you navigate the evolving landscape of business, you’re likely aware that traditional models are no longer sufficient. You need a strategy that incorporates cutting-edge technology, such as artificial intelligence, to drive growth and profitability. Your goal is to create a sustainable wealth model that not only generates revenue but also adapts to changing market conditions. You will learn how to leverage AI to streamline operations, make data-driven decisions, and stay ahead of the competition in this new age of business.

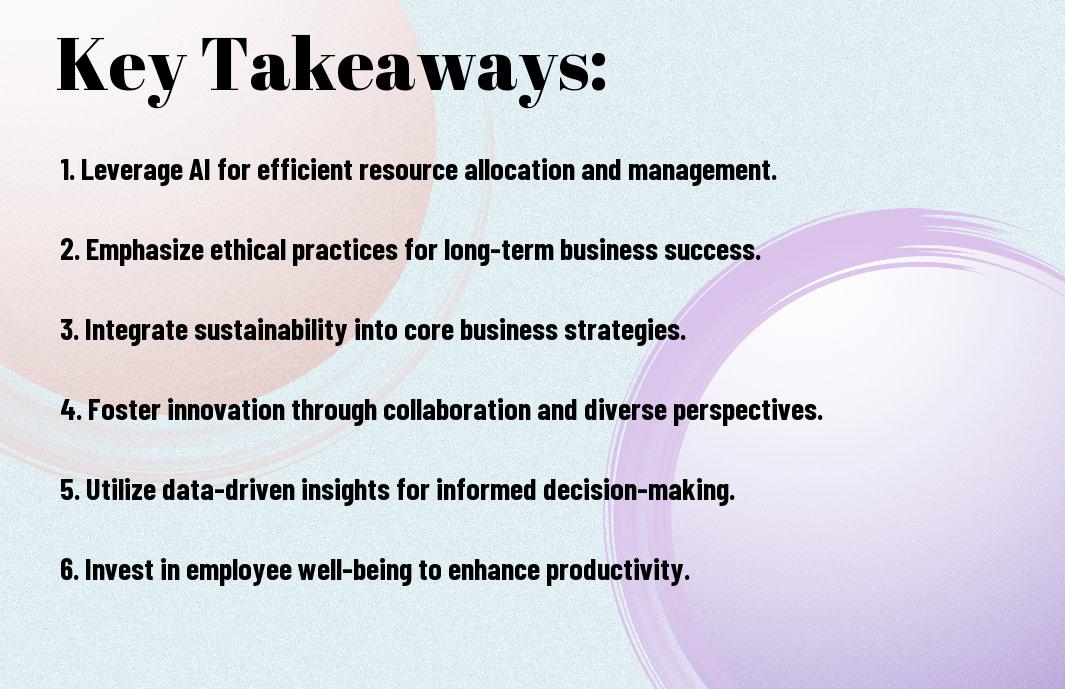

Key Takeaways:

- Embracing artificial intelligence (AI) is vital for businesses to create a sustainable wealth model, as it enables them to automate processes, enhance efficiency, and drive innovation, ultimately leading to increased profitability and competitiveness.

- A sustainable wealth model powered by AI requires a strategic approach to data management, including collection, analysis, and interpretation, to inform business decisions and stay ahead of the competition.

- AI-driven business models can help companies reduce their environmental footprint by optimizing resource allocation, streamlining operations, and promoting sustainable practices throughout their supply chains.

- The integration of AI in business operations also necessitates a significant shift in workforce skills, with a greater emphasis on developing expertise in areas such as machine learning, data science, and digital literacy.

- By leveraging AI and adopting a sustainable wealth model, businesses can create long-term value, foster economic growth, and contribute to a more equitable and prosperous society, while also ensuring their own resilience and success in an increasingly complex and interconnected world.

The Economic Machine of AI

To understand the impact of AI on your business, consider how it’s transforming industries, as seen in AI to transform wealth management, Microsoft executive says, which will change your approach to wealth creation.

Fundamental Shifts in Value Creation

At the heart of this transformation, you’ll find significant changes in how value is created, affecting your business model and requiring adaptations to stay competitive in the new AI-driven economy.

Productivity Paradox Resolved

Fundamentally, the integration of AI resolves the productivity paradox, where you can now leverage technology to enhance efficiency and output, directly impacting your bottom line.

But as you probe deeper into the productivity paradox, you’ll discover that AI not only automates routine tasks, freeing your resources for strategic decisions, but also provides insights that help you optimize operations, leading to sustained growth and competitiveness in your market, allowing you to create a sustainable wealth model that thrives in the new age of business.

First Principles of Digital Wealth

There’s a new paradigm shift in the way you create and manage wealth, and it’s driven by digital technologies. As you navigate this new landscape, understanding the fundamental principles of digital wealth is imperative to your success.

Network Effects as Capital

The key to unlocking digital wealth lies in your ability to leverage network effects, where the value of a product or service increases exponentially with each new user. You can harness this power to create a self-reinforcing cycle of growth and profitability.

Data as the New Oil

Between the lines of code and algorithms, data has emerged as the lifeblood of digital businesses, driving innovation and growth. You need to recognize the value of data in your business and learn to extract insights from it to stay ahead of the competition.

Data is the foundation upon which you can build your digital wealth model, and its importance cannot be overstated. As you collect and analyze data, you’ll gain a deeper understanding of your customers, markets, and operations, enabling you to make informed decisions and drive your business forward. You’ll be able to identify new opportunities, optimize your processes, and create new revenue streams, ultimately leading to sustained growth and profitability in your digital ventures.

Algorithmic Decision Making

Despite the complexity of business decisions, you can now rely on algorithms to guide your choices, enabling data-driven decision-making and reducing reliance on intuition.

From Intuition to Evidence

Towards a more informed approach, you shift from relying on gut feelings to making decisions based on empirical evidence, allowing your business to thrive in a data-rich environment.

The Feedback Loop Economy

Taking your business to the next level, you enter an economy where continuous feedback loops refine your decision-making processes, enabling your organization to adapt and evolve rapidly.

Economy that is driven by feedback loops offers you a unique opportunity to create a self-improving system, where your business decisions are constantly refined by the data generated from previous choices, allowing you to stay ahead of the competition and achieve sustainable growth.

Risk Hedging in Technological Transformation

After investing in AI-driven technologies, you need to consider risk hedging strategies to protect your business from potential disruptions. This involves assessing potential risks and developing contingency plans to mitigate their impact on your operations.

Diversification Across Innovation Curves

Prior to focusing on a single technology, you should diversify your investments across different innovation curves to minimize risk and maximize returns, ensuring your business remains competitive in a rapidly changing market.

Resilience Through Redundancy

Transforming your business to incorporate redundant systems and processes can help you build resilience against technological failures or disruptions, allowing you to quickly adapt and continue operating with minimal downtime.

This approach to resilience through redundancy involves creating duplicate systems, processes, and supply chains to ensure that if one fails, others can take over, minimizing the impact on your business and allowing you to maintain continuity, which is crucial for your long-term success and ability to navigate the challenges of technological transformation.

Market Cycles in the AI Economy

For businesses to thrive in the AI economy, you need to understand market cycles. You can learn more about creating wealth with AI by downloading the Ai Wealth Creation Blueprint Pdf, which provides valuable insights into this new era of business.

Creative Destruction Patterns

Around every corner, new technologies emerge, disrupting traditional industries and creating new opportunities for growth, allowing you to adapt and innovate in the AI-driven market.

Identifying Long-Term Trends

Cycles of innovation and disruption are inherent in the AI economy, and you must identify long-term trends to make informed decisions and stay ahead of the competition.

Also, as you explore deeper into the AI economy, you will find that identifying long-term trends requires a deep understanding of the complex interplay between technological advancements, market demands, and societal needs, enabling you to make strategic decisions that drive your business forward.

Building Sustainable Business Models

Once again, you’ll need to rethink your approach to creating a sustainable wealth model, focusing on long-term growth and environmental responsibility, as you develop your business strategy, you’ll find that AI can help you make more informed decisions.

Regenerative Value Propositions

Across various industries, you’ll find that regenerative value propositions are becoming increasingly important, as you consider the impact of your business on the environment and society, you can use AI to identify areas for improvement and develop more sustainable practices.

Stakeholder-Centric Approaches

Beside financial gains, you should also consider the needs and interests of your stakeholders, including employees, customers, and the wider community, as you develop a stakeholder-centric approach, you can use AI to analyze data and make more informed decisions.

To implement a stakeholder-centric approach, you’ll need to engage with your stakeholders, understand their needs, and develop strategies that balance their interests with your business goals, by doing so, you can create a more sustainable and equitable business model that benefits everyone involved, and AI can help you navigate this complex process, providing you with valuable insights and data-driven recommendations.

Conclusion

Following this exploration of creating a sustainable wealth model, you now have a deeper understanding of how AI is revolutionizing the business landscape. As you navigate your own business journey, you will be able to leverage AI to drive growth and profitability. Your ability to adapt and innovate will be key to success in this new age of business, and with the right strategies, you can build a thriving and sustainable wealth model that sets you up for long-term success.

FAQ

Q: What is the role of Artificial Intelligence in creating a sustainable wealth model for businesses?

A: Artificial Intelligence (AI) plays a significant role in creating a sustainable wealth model for businesses by providing innovative solutions to optimize operations, enhance customer experience, and drive growth. AI-powered tools can analyze vast amounts of data to identify trends, predict market fluctuations, and provide actionable insights, enabling businesses to make informed decisions and stay ahead of the competition. By leveraging AI, companies can streamline processes, reduce costs, and improve efficiency, ultimately leading to increased profitability and sustainability.

Q: How can businesses adapt to the new age of business driven by technological advancements and AI?

A: To adapt to the new age of business, companies must be willing to embrace change and invest in digital transformation. This involves developing a strategic plan to integrate AI and other emerging technologies into their operations, such as machine learning, blockchain, and the Internet of Things (IoT). Businesses should also focus on upskilling and reskilling their workforce to ensure they have the necessary expertise to work effectively with AI systems. Additionally, companies must prioritize data-driven decision-making, foster a culture of innovation, and be prepared to pivot quickly in response to changing market conditions and customer needs.

Q: What are the key benefits of creating a sustainable wealth model that incorporates AI and other emerging technologies?

A: The key benefits of creating a sustainable wealth model that incorporates AI and other emerging technologies include increased efficiency, improved decision-making, enhanced customer experience, and accelerated growth. By leveraging AI, businesses can automate routine tasks, freeing up resources to focus on high-value activities such as strategy, innovation, and customer engagement. Additionally, AI-powered systems can provide real-time insights and predictive analytics, enabling companies to respond quickly to changing market conditions and stay ahead of the competition. Ultimately, a sustainable wealth model that incorporates AI and other emerging technologies can help businesses achieve long-term success, drive profitability, and create lasting value for stakeholders.