As you navigate your journey to financial freedom, you’re likely exploring various strategies to optimize your wealth creation. You’re about to discover how automation, powered by Artificial Intelligence (AI), can significantly accelerate your progress. By leveraging AI-driven tools, you can streamline your financial operations, make data-driven decisions, and unlock new opportunities for growth, ultimately transforming your path to wealth accumulation and securing your financial future.

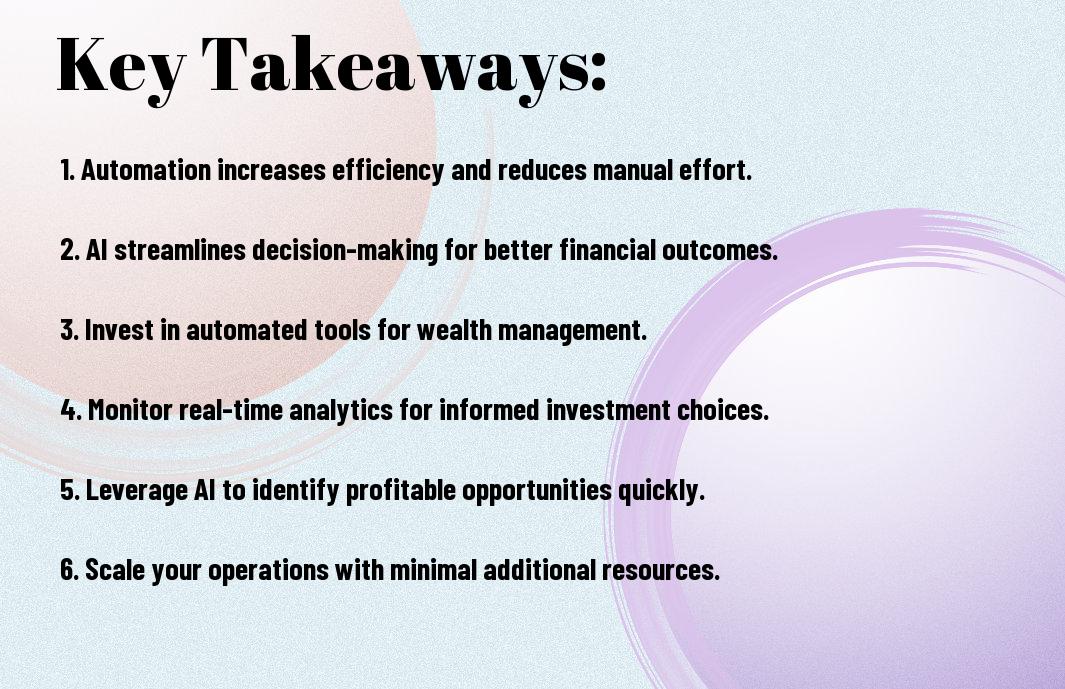

Key Takeaways:

- Automating tasks and processes using AI can significantly increase productivity and efficiency, allowing individuals to focus on high-leverage activities that generate more wealth.

- AI-powered tools can help analyze large amounts of data, identify patterns, and make predictions, enabling informed investment decisions and strategic business moves.

- By leveraging AI and automation, individuals can create passive income streams, reduce costs, and scale their businesses more quickly, ultimately accelerating their path to financial freedom and wealth creation.

The Wealth Acceleration Paradox

Achieving wealth acceleration is a goal for many, but it often seems elusive. You may be working hard, investing wisely, and saving diligently, yet your progress may be slower than you expect. The key to breaking through this paradox lies in leveraging the power of automation and AI to accelerate your path to wealth.

Traditional Wealth Building vs. AI-Enhanced Methods

Augmenting your wealth-building strategies with AI can significantly enhance your results. You can use AI-enhanced methods to optimize your investments, streamline your finances, and make data-driven decisions to maximize your returns, helping you achieve your financial goals faster.

The Psychological Barriers to Automation

About to launch on your automation journey, you may encounter psychological barriers that hold you back. You may feel uncertain about the benefits of automation or hesitant to trust AI with your financial decisions.

This hesitation is natural, but it’s vital to understand that automation is designed to work in your favor, helping you make the most of your time and resources. As you start to automate your wealth-building strategies, you’ll begin to see the benefits of increased efficiency, reduced stress, and accelerated progress towards your financial goals, allowing you to achieve the wealth and freedom you desire.

AI Financial Tools Landscape

While navigating the world of AI financial tools, you’ll discover a wide range of innovative solutions designed to streamline your investment journey. You can leverage these tools to make informed decisions, optimize your portfolio, and accelerate your path to wealth.

Robo-Advisors and Portfolio Optimization

Against the backdrop of traditional financial advisory services, robo-advisors offer a cost-effective and efficient way to manage your investments, providing you with personalized portfolio optimization and diversification strategies.

Predictive Analytics for Market Timing

Timing is everything when it comes to investing, and predictive analytics can help you make data-driven decisions to maximize your returns, allowing you to stay ahead of the market and adjust your strategy accordingly.

And as you explore deeper into predictive analytics, you’ll find that these tools can analyze vast amounts of market data, identifying patterns and trends that may not be immediately apparent, giving you a unique edge in the market and enabling you to make more informed investment decisions that align with your financial goals.

Passive Income Generation Through AI

For those looking to accelerate their path to wealth, AI-powered automation can be a game-changer, enabling you to generate passive income with minimal effort, allowing your wealth to grow exponentially over time, and giving you the financial freedom you desire.

Algorithmic Trading Systems

Across various financial markets, you can leverage AI-driven algorithmic trading systems to make data-driven investment decisions, executing trades at optimal times to maximize your returns, and helping you build a diversified investment portfolio that aligns with your financial goals.

Automated Content Monetization

Through the power of AI, you can automate the process of creating and monetizing content, such as blog posts, videos, and social media posts, allowing you to reach a wider audience and generate passive income from advertising, sponsorships, and affiliate marketing, all while minimizing your time and effort.

At the heart of automated content monetization is the ability to analyze your audience’s preferences and tailor your content to meet their needs, using AI-powered tools to optimize your content for maximum engagement and conversion, and helping you build a loyal following that drives your passive income streams, enabling you to achieve your financial objectives and secure your financial future.

Risk Management in the Age of Automation

Many investors are turning to automation to manage risk and maximize returns. You can use AI to analyze market trends, identify potential risks, and adjust your portfolio accordingly. By leveraging automation, you can make informed decisions and minimize losses.

Diversification Strategies Using AI

Across various asset classes, you can use AI to diversify your portfolio and reduce risk. You can invest in a range of assets, from stocks to real estate, and use AI to optimize your investments and maximize returns.

Fraud Detection and Prevention Systems

Between the lines of code, AI-powered systems can detect and prevent fraud, protecting your investments from cyber threats. You can use these systems to monitor your accounts and alert you to any suspicious activity.

Strategies for implementing effective fraud detection and prevention systems include using machine learning algorithms to analyze patterns and anomalies, and implementing robust security protocols to protect your data. You can also use AI to stay one step ahead of potential threats, and adjust your security measures accordingly to safeguard your investments.

The Social Implications of AI Wealth

All aspects of your life will be impacted by the integration of AI in wealth creation, and it’s imperative to consider the broader social implications. You will need to navigate the effects of AI on your financial future and the potential consequences for your community.

Wealth Gaps and Technological Access

Along with the benefits of AI-driven wealth, you may notice a widening gap between those with access to technology and those without. You will have to consider how this disparity affects your own financial situation and the overall economic landscape.

Ethical Considerations of Automated Wealth

Wealth generated through AI raises important questions about fairness and accountability. You will need to think critically about the potential biases in AI systems and how they might impact your financial decisions.

Also, as you explore the ethical considerations of automated wealth, you should consider the potential consequences of relying on AI for financial decision-making. You will want to ensure that your values and principles are reflected in the AI systems you use, and that you are not inadvertently perpetuating existing social inequalities. You will need to stay informed and adapt to the evolving landscape of AI-driven wealth creation to make the most of its potential benefits.

Implementation Roadmap

After laying the groundwork, you can begin to implement AI-powered automation in your wealth-building strategy, streamlining processes and increasing efficiency to accelerate your path to financial freedom.

Starting Small: Entry-Level Automation

On the path to automation, you start by identifying areas where AI can simplify tasks, such as data analysis or investment tracking, allowing you to focus on high-leverage activities that drive wealth growth.

Scaling Your AI Wealth System

Beside the initial setup, you will need to continuously monitor and adjust your automation systems to ensure they align with your evolving financial goals and adapt to market changes.

To scale your AI wealth system effectively, you will need to integrate more advanced tools and strategies, such as machine learning algorithms and natural language processing, which can provide deeper insights into market trends and help you make more informed investment decisions, thereby maximizing your returns and solidifying your financial future.

Conclusion

To wrap up, you now have the tools to harness the power of automation, leveraging AI to accelerate your path to wealth. You can streamline processes, increase efficiency, and make data-driven decisions, ultimately amplifying your financial gains. By embracing automation, you will unlock new opportunities, freeing up time to focus on high-leverage activities that drive your wealth forward, and securing your financial future. Your journey to prosperity starts with the strategic use of AI-powered automation.

FAQ

Q: What is the concept of “The Power of Automation” and how can it help me achieve wealth?

A: The Power of Automation refers to the use of Artificial Intelligence (AI) and other technologies to automate various aspects of business and investing, allowing individuals to streamline their operations, increase efficiency, and generate passive income. By leveraging automation, you can free up time and resources to focus on high-leverage activities, make data-driven decisions, and accelerate your path to wealth.

Q: How can AI be used to automate my investment decisions and what are the benefits of doing so?

A: AI can be used to automate investment decisions by analyzing large amounts of market data, identifying trends, and making predictions about future market movements. The benefits of using AI in investment decisions include increased accuracy, reduced emotional bias, and the ability to make trades at optimal times. Additionally, AI can help you diversify your portfolio, manage risk, and optimize your returns, leading to more consistent and reliable investment performance.

Q: What are some common applications of automation in business and how can they help me increase my wealth?

A: Common applications of automation in business include marketing automation, customer service automation, and accounting automation. These applications can help you increase your wealth by reducing labor costs, increasing productivity, and improving customer engagement. For example, marketing automation can help you personalize your marketing messages, nurture leads, and convert prospects into customers, while customer service automation can help you provide 24/7 support and improve customer satisfaction.

Q: How do I get started with automation and what are the key steps to implementing AI-powered automation in my business or investments?

A: To get started with automation, you need to identify areas of your business or investments that can be automated, and then select the right tools and technologies to automate those tasks. The key steps to implementing AI-powered automation include defining your goals and objectives, selecting the right AI platform or tool, integrating the tool with your existing systems, and monitoring and optimizing the automation process. You may also need to invest in training and education to develop the skills and knowledge needed to effectively implement and manage automation.

Q: What are the potential risks and challenges associated with automation and how can I mitigate them to ensure successful implementation?

A: The potential risks and challenges associated with automation include job displacement, data security risks, and technological failures. To mitigate these risks, you need to carefully plan and implement automation, ensuring that you have the right skills and resources in place. You should also monitor and evaluate the automation process regularly, addressing any issues or problems that arise promptly. Additionally, you may need to invest in cybersecurity measures to protect your data and systems, and develop strategies to upskill or reskill workers who may be displaced by automation.