As you navigate the complex world of investments, you’re constantly seeking ways to maximize your returns. Your goal is to make informed decisions that drive growth and profitability. With the advent of artificial intelligence (AI), you now have a powerful tool at your disposal to identify lucrative business opportunities. By leveraging AI, you can analyze vast amounts of data, uncover hidden patterns, and make data-driven decisions that propel your investments forward.

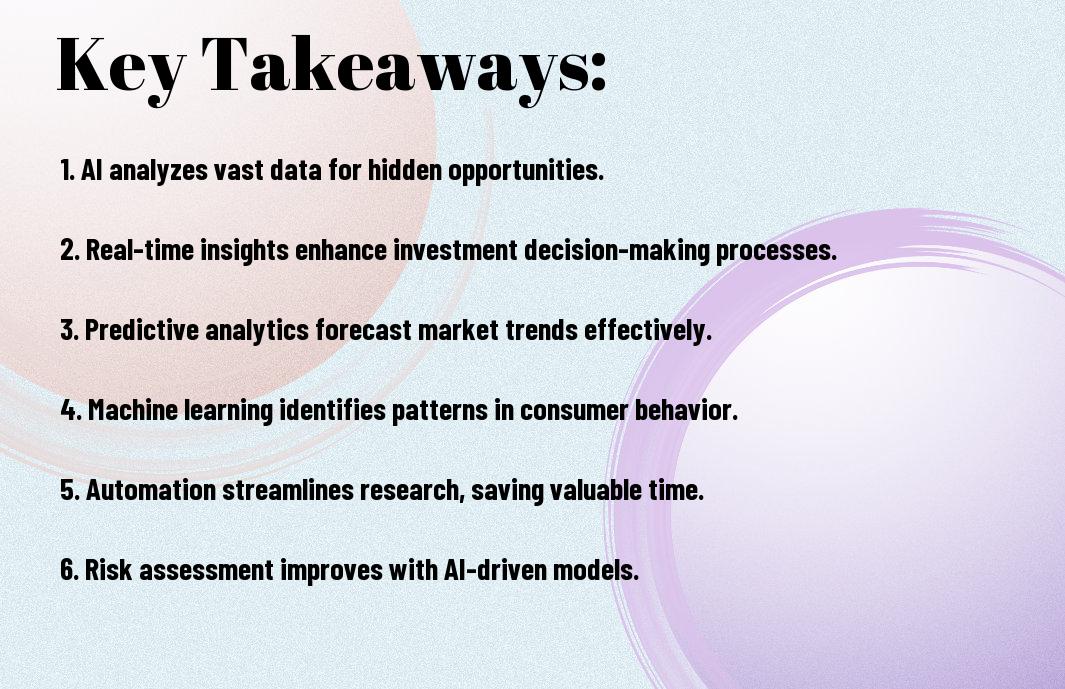

Key Takeaways:

- Utilizing AI in investment decisions can significantly enhance the ability to identify lucrative business opportunities by analyzing vast amounts of data and recognizing patterns that may not be apparent to human analysts.

- A key benefit of AI-driven investment strategies is their ability to process and analyze real-time data, allowing for more timely and informed investment decisions that can lead to higher returns.

- AI can help diversify investment portfolios by identifying opportunities across various sectors and asset classes, reducing reliance on traditional investment avenues and potentially increasing overall portfolio performance.

- Implementing AI in investment analysis can also help mitigate risks by identifying potential pitfalls and warning signs that may indicate a business or investment is likely to underperform.

- As AI technology continues to evolve, it is likely to play an increasingly significant role in the investment landscape, making it vital for investors to understand and leverage its capabilities to stay ahead in the market.

The AI Revolution in Investment Analysis

The advent of AI has transformed the investment landscape, enabling you to make informed decisions with unprecedented accuracy. You can now leverage AI-powered tools to analyze vast amounts of data, identify trends, and predict market fluctuations.

Machine Learning Algorithms for Market Prediction

Predictive models are being used to forecast market trends, allowing you to stay ahead of the curve. You can utilize machine learning algorithms to analyze historical data and make informed investment decisions.

Natural Language Processing for Sentiment Analysis

Any investor can benefit from natural language processing, which analyzes market sentiment and provides valuable insights. You can use this technology to gauge public opinion and make informed decisions about your investments.

Plus, with natural language processing, you can analyze large volumes of text data from various sources, including news articles and social media posts, to determine the overall sentiment towards a particular stock or market trend, enabling you to adjust your investment strategy accordingly.

Data-Driven Decision Making

If you’re looking to make informed investment decisions, you can leverage AI to analyze market trends and identify opportunities. You can learn more about 7 Unexpected Ways AI Can Transform Your Investment Strategy to maximize your returns.

Big Data Analytics in Opportunity Identification

Any investment decision you make should be backed by data, and big data analytics can help you identify lucrative opportunities by analyzing market trends and consumer behavior, allowing you to make informed decisions.

Predictive Modeling for Investment Returns

Against the backdrop of market volatility, predictive modeling can help you forecast investment returns and minimize risk, enabling you to make strategic decisions that drive your portfolio’s growth.

Considering the complexity of predictive modeling, you can use machine learning algorithms to analyze historical data and identify patterns that inform your investment strategy, helping you to optimize your portfolio and achieve your financial goals.

AI-Powered Market Research

Many businesses are leveraging AI to gain valuable insights into their target markets, allowing you to make informed decisions about your investments. You can analyze large datasets, identify patterns, and uncover new opportunities with AI-powered market research.

Competitive Intelligence Automation

Alongside this, an added benefit of AI-powered market research is the ability to automate competitive intelligence, enabling you to stay ahead of your competitors and identify gaps in the market that you can capitalize on, tailoring your strategy to your unique strengths.

Trend Forecasting Capabilities

The ability to forecast trends is a key aspect of AI-powered market research, allowing you to anticipate changes in the market and adjust your investments accordingly, giving you a competitive edge and enabling you to make the most of emerging opportunities.

Hence, as you investigate deeper into trend forecasting capabilities, you will discover that AI algorithms can analyze historical data, seasonal fluctuations, and other factors to predict future market trends, enabling you to make informed decisions about your investments and stay ahead of the curve, maximizing your returns and minimizing your risks, allowing you to achieve your financial goals.

Risk Assessment Through Artificial Intelligence

Your investment decisions can be significantly improved by leveraging artificial intelligence (AI) to assess potential risks. AI algorithms can analyze vast amounts of data, identifying patterns and predicting outcomes that may not be apparent to human analysts.

Quantitative Risk Evaluation Models

By utilizing advanced statistical models, you can quantify potential risks and make more informed investment decisions. These models enable you to assess the likelihood and potential impact of various risk factors, allowing you to adjust your strategy accordingly.

Scenario Simulation and Stress Testing

Around the globe, investors are using AI-powered scenario simulation and stress testing to anticipate potential risks and opportunities. This approach enables you to simulate different market scenarios, testing your investment strategy against a range of possible outcomes.

With scenario simulation and stress testing, you can gain a deeper understanding of your investment’s potential vulnerabilities and develop strategies to mitigate them. You can simulate various market conditions, such as economic downturns or regulatory changes, and assess the potential impact on your investment, allowing you to make more informed decisions and minimize potential losses.

Sector-Specific AI Applications

Keep in mind that AI can be applied to various sectors, and understanding these applications is key to making informed investment decisions. You can leverage AI to identify opportunities in industries such as finance, real estate, and healthcare, allowing you to diversify your portfolio and maximize returns.

Fintech Innovations

Above all, fintech innovations are transforming the financial landscape, and you can capitalize on this trend by investing in AI-powered fintech companies that offer innovative solutions for payment processing, lending, and investment management.

Real Estate and Infrastructure Opportunities

Applications of AI in real estate and infrastructure are vast, and you can use AI to analyze market trends, identify lucrative investment opportunities, and optimize property management, enabling you to make data-driven decisions and increase your returns.

Further, as you explore real estate and infrastructure opportunities, you’ll find that AI can help you assess the potential of different projects, from residential and commercial developments to infrastructure initiatives, allowing you to mitigate risks and capitalize on emerging trends, ultimately growing your wealth and securing your financial future.

Implementation Strategies

Unlike traditional investment approaches, using AI to identify lucrative business opportunities requires a thoughtful and multi-step implementation process, allowing you to leverage data-driven insights and maximize your returns, as you navigate the complex landscape of investment opportunities.

Building an AI Investment Framework

Implementing a well-structured AI investment framework enables you to systematically evaluate and prioritize potential investments, using machine learning algorithms to analyze market trends and identify promising opportunities that align with your investment goals and risk tolerance.

Integration with Existing Business Processes

Among the key considerations for successful AI integration is ensuring seamless alignment with your existing business processes, allowing you to efficiently incorporate AI-driven insights into your investment decision-making, and streamline your overall investment strategy, as you work to optimize your portfolio and achieve your financial objectives.

Also, as you integrate AI into your existing business processes, you will be able to automate many routine tasks, freeing up more time for you to focus on higher-level strategic decision-making, and enabling you to respond more quickly to changing market conditions, ultimately giving you a competitive edge in the investment landscape, and allowing you to make more informed, data-driven decisions that drive your long-term success.

To wrap up

With these considerations, you can harness the power of AI to identify lucrative business opportunities, maximizing your returns on investment. By leveraging AI-driven insights, you will make informed decisions, driving your business forward. Your ability to analyze market trends and patterns will enable you to stay ahead of the competition, securing your position in the market and ensuring long-term success for your investments.

FAQ

Q: What is Smart Investment and how can AI help in identifying lucrative business opportunities?

A: Smart Investment refers to the use of advanced technologies, such as Artificial Intelligence (AI), to analyze and identify potentially profitable investment opportunities. AI can help in this process by quickly and efficiently analyzing large amounts of data, identifying patterns, and making predictions about future market trends. This allows investors to make informed decisions and maximize their returns. With AI-powered tools, investors can analyze various factors such as market trends, financial statements, and industry developments to identify lucrative business opportunities that may not be immediately apparent through traditional analysis methods.

Q: How does AI analyze data to identify lucrative business opportunities, and what types of data does it use?

A: AI analyzes data to identify lucrative business opportunities by using machine learning algorithms that can process and analyze large amounts of data from various sources, such as financial reports, market research, social media, and news articles. The AI system can analyze data on factors such as revenue growth, market size, competition, customer demographics, and industry trends. It can also analyze unstructured data, such as social media posts and customer reviews, to gauge market sentiment and identify emerging trends. By analyzing these various data points, AI can identify patterns and correlations that may indicate a lucrative business opportunity, and provide investors with actionable insights to inform their investment decisions.

Q: What are the benefits of using AI to identify lucrative business opportunities, and how can it help investors make better investment decisions?

A: The benefits of using AI to identify lucrative business opportunities include increased efficiency, improved accuracy, and enhanced decision-making capabilities. AI can quickly analyze large amounts of data, identify potential opportunities, and provide investors with real-time insights and recommendations. This can help investors to make more informed decisions, reduce the risk of investment losses, and maximize their returns. Additionally, AI can help investors to diversify their portfolios, identify emerging trends and industries, and stay ahead of the competition. By leveraging AI-powered investment tools, investors can gain a competitive edge in the market and achieve their investment goals more effectively.