As you navigate the complex world of entrepreneurship, you’re constantly seeking ways to make informed decisions and drive growth. Your ability to analyze data and make smart investments is key to staying ahead of the competition. With the rise of artificial intelligence (AI), you now have the power to leverage data-driven insights to optimize your investment strategies and maximize returns. By harnessing the potential of AI, you can unlock new opportunities and take your business to the next level.

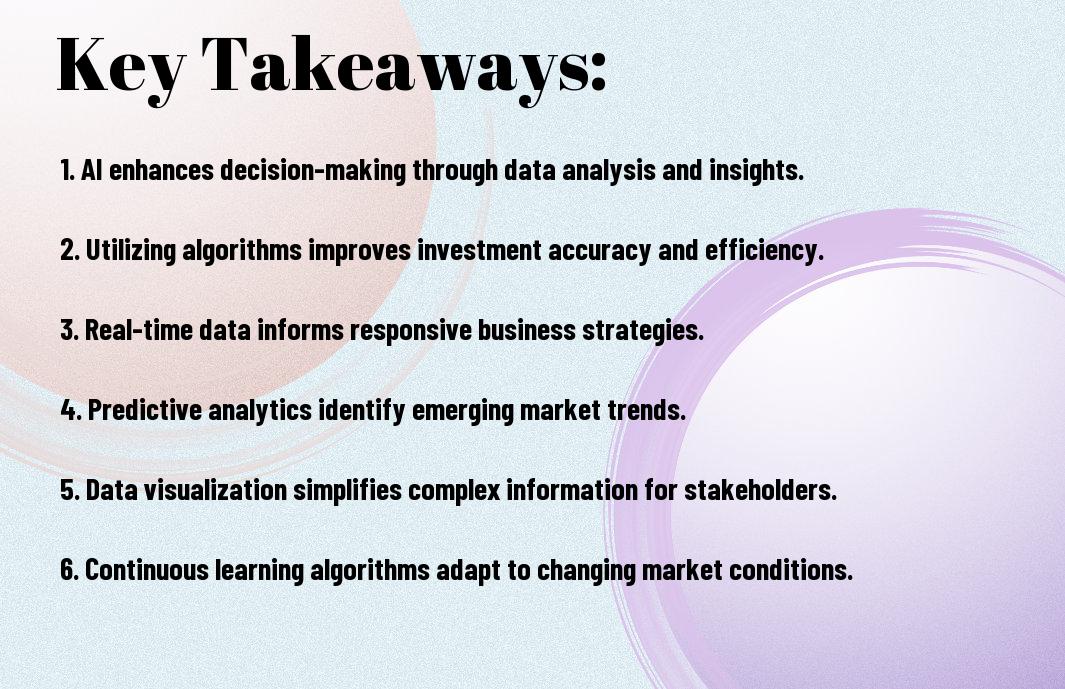

Key Takeaways:

- Data-driven entrepreneurship involves using artificial intelligence (AI) and data analysis to inform investment decisions, reducing reliance on intuition and increasing the potential for success.

- AI can be used to analyze large datasets, identify patterns, and predict market trends, allowing entrepreneurs to make more informed decisions about where to invest their resources.

- By leveraging AI, entrepreneurs can automate many of the tasks involved in data analysis, freeing up time to focus on higher-level strategic decisions and driving business growth.

- AI-driven insights can help entrepreneurs to identify new opportunities and mitigate risks, enabling them to stay ahead of the competition and adapt to changing market conditions.

- Effective implementation of AI in entrepreneurship requires a combination of technical expertise, business acumen, and a willingness to experiment and innovate, in order to unlock the full potential of data-driven decision making.

The Evolution of Investment Decision-Making

The investment landscape has undergone significant transformations over the years, and you are now witnessing a paradigm shift towards data-driven approaches. As you consider your investment options, it’s imperative to understand how AI is revolutionizing the way you make informed decisions.

Traditional Approaches vs. Data-Driven Methods

On the one hand, traditional methods relied heavily on intuition and experience, whereas data-driven methods leverage AI to analyze vast amounts of data, providing you with actionable insights to make smarter investments.

The Tipping Point for AI in Investment

Against the backdrop of increasing market volatility, you are likely to find that AI-powered investment tools are becoming increasingly indispensable, enabling you to navigate complex market trends with greater precision.

Hence, as you explore the potential of AI in investment, you will discover that it can help you identify high-growth opportunities, mitigate risks, and optimize your portfolio performance, ultimately giving you a competitive edge in the market. You will be able to make more accurate predictions, and your investment decisions will be backed by data-driven insights, allowing you to stay ahead of the curve.

Key AI Technologies Transforming Entrepreneurial Investments

Some of the most significant AI technologies transforming entrepreneurial investments include machine learning, predictive analytics, and natural language processing. You can leverage these technologies to make data-driven decisions and gain a competitive edge in the market. Your ability to adapt to these technologies will be important in driving your business forward.

Predictive Analytics and Pattern Recognition

Besides traditional investment methods, you can use predictive analytics to identify patterns and trends in the market. Your investments will become more informed, allowing you to mitigate risks and capitalize on opportunities. You will be able to make smarter decisions with the insights gained from predictive analytics.

Natural Language Processing for Market Intelligence

Processing large amounts of market data can be overwhelming, but natural language processing (NLP) can help you make sense of it. You can use NLP to analyze market trends, customer sentiment, and competitor activity, giving you a deeper understanding of the market landscape. Your market intelligence will be enhanced, enabling you to make more informed investment decisions.

Even with the vast amount of market data available, you can use NLP to extract actionable insights and stay ahead of the competition. You will be able to analyze news articles, social media posts, and other sources of market information to identify trends and patterns that can inform your investment decisions. Your ability to analyze large amounts of data quickly and accurately will give you a significant advantage in the market, allowing you to make smarter investments and drive your business forward.

Building Your Data-Driven Investment Framework

Unlike traditional investment approaches, a data-driven framework allows you to make informed decisions based on insights from AI-driven analytics, enabling you to identify trends and patterns that inform your investment strategy.

Essential Metrics and KPIs

One of the key components of your framework will be the metrics and KPIs you use to measure performance, which will help you evaluate the success of your investments and make adjustments as needed, allowing you to refine your strategy over time.

Creating Feedback Loops for Continuous Improvement

DataDriven decision-making relies on continuous feedback, which enables you to assess the effectiveness of your investments and make adjustments in real-time, ensuring your strategy remains optimized and aligned with your goals.

KPIs will play a significant role in creating feedback loops, as they provide a clear indication of your investment’s performance, allowing you to identify areas for improvement and make data-driven decisions to adjust your strategy, ensuring you stay on track to meet your investment objectives, and enabling you to make smarter investments that drive long-term growth and success.

Overcoming Cognitive Biases Through AI

Despite the best intentions, your investment decisions can be influenced by cognitive biases, leading to suboptimal outcomes. By leveraging AI, you can make more informed decisions and avoid common pitfalls.

Recognizing Human Decision Errors

Decisively, you must acknowledge that human decision-making is prone to errors, and your own biases can impact your investment choices. AI can help identify these biases and provide a more objective perspective.

How AI Provides Objective Counterbalance

Cognitively, you can benefit from AI’s ability to analyze large datasets and provide unbiased insights, helping you make more informed investment decisions. AI can identify patterns and trends that may elude you, ensuring your investments are based on data-driven evidence.

But as you probe deeper into the capabilities of AI, you’ll find that it can also help you refine your investment strategy by continuously learning from your decisions and adapting to changing market conditions, allowing you to make adjustments and optimize your portfolio for better returns, ultimately helping you achieve your investment goals.

The Human-AI Partnership

Now that you’re exploring the potential of AI in entrepreneurship, you’ll discover that the most successful approaches involve a harmonious blend of human insight and artificial intelligence, enabling you to make more informed investment decisions.

Where Human Intuition Still Matters

Contrary to the notion that AI replaces human judgment, your intuition and experience are still vital in identifying opportunities that AI systems might overlook, allowing you to guide the decision-making process with a deeper understanding of market nuances.

Designing Effective Collaboration Models

Pairing your expertise with AI’s analytical capabilities, you can create a powerful synergy that enhances your investment strategy, as you learn to leverage the strengths of both human and artificial intelligence to drive your entrepreneurial endeavors forward.

Effective collaboration models involve understanding how to divide tasks between humans and AI systems, allowing you to focus on high-level strategic decisions while AI handles data analysis and pattern recognition, thereby streamlining your investment process and improving overall performance, as you navigate the complex landscape of data-driven entrepreneurship with greater confidence and precision.

Ethical Considerations in AI-Powered Investing

Keep in mind that as you leverage AI for investing, you must consider the ethical implications, such as transparency and bias, to ensure your decisions are fair and unbiased, you can learn more about Harnessing AI and Machine Learning for Smarter Data Analytics Strategies to make informed choices.

Transparency and Explainability

Between the lines of code and complex algorithms, you need to understand how AI-driven investment decisions are made, to trust the process and identify potential flaws, ensuring your investments are aligned with your values and goals.

Addressing Algorithmic Bias

Above all, you should be aware of the potential for algorithmic bias in AI-powered investing, which can lead to unfair outcomes and discrimination, it’s necessary to monitor and address these biases to maintain the integrity of your investment decisions.

Ethical considerations in AI-powered investing are multifaceted, and addressing algorithmic bias is a key aspect, as you work to eliminate biases, you’ll need to continually test and validate your AI systems, ensuring they are fair, transparent, and aligned with your investment goals and values, by doing so, you can trust your AI-driven investment decisions and maintain a competitive edge in the market.

Summing up

Summing up, you now have the tools to leverage AI in your investment decisions, making your entrepreneurship journey more efficient. You can analyze data to identify trends, optimize operations, and mitigate risks. By embracing data-driven entrepreneurship, you will make smarter investments, driving your business forward and staying ahead of the competition. Your ability to adapt and innovate will be the key to your success in this rapidly evolving landscape.

FAQ

Q: What is Data-Driven Entrepreneurship and how does it relate to leveraging AI for smarter investments?

A: Data-Driven Entrepreneurship refers to the practice of using data analysis and interpretation to inform business decisions, drive innovation, and optimize operations. By leveraging Artificial Intelligence (AI), entrepreneurs can analyze large datasets, identify patterns, and make predictions to inform their investment decisions. This approach enables entrepreneurs to minimize risks, maximize returns, and stay ahead of the competition. With AI-powered tools, entrepreneurs can process vast amounts of data, including market trends, customer behavior, and financial metrics, to make informed decisions and drive business growth.

Q: How can AI be used to analyze market trends and make predictions for smarter investments in Data-Driven Entrepreneurship?

A: AI can be used to analyze market trends and make predictions by utilizing machine learning algorithms, natural language processing, and predictive modeling. These techniques enable entrepreneurs to analyze large datasets, including social media, news articles, and financial reports, to identify patterns and trends that may impact their investments. AI-powered tools can also analyze customer behavior, preferences, and demographics to predict market demand and identify potential opportunities for growth. By leveraging AI, entrepreneurs can gain valuable insights into market trends, make data-driven decisions, and stay ahead of the competition.

Q: What are the benefits of using AI in Data-Driven Entrepreneurship, and how can it help entrepreneurs make smarter investment decisions?

A: The benefits of using AI in Data-Driven Entrepreneurship include improved decision-making, increased efficiency, and enhanced risk management. AI-powered tools can analyze large datasets, identify potential risks, and provide entrepreneurs with data-driven insights to inform their investment decisions. Additionally, AI can help entrepreneurs to identify new business opportunities, optimize operations, and improve customer engagement. By leveraging AI, entrepreneurs can make smarter investment decisions, drive business growth, and achieve a competitive advantage in the market. Overall, AI is a powerful tool that can help entrepreneurs to navigate complex business environments, make informed decisions, and achieve their goals.